Featured

Table of Contents

Insurance companies will not pay a small. Rather, consider leaving the cash to an estate or count on. For even more extensive info on life insurance policy get a duplicate of the NAIC Life Insurance Buyers Guide.

The IRS puts a limit on just how much cash can enter into life insurance policy premiums for the plan and just how swiftly such premiums can be paid in order for the policy to preserve all of its tax obligation advantages. If particular limitations are exceeded, a MEC results. MEC policyholders might be subject to tax obligations on distributions on an income-first basis, that is, to the degree there is gain in their policies, in addition to fines on any type of taxable amount if they are not age 59 1/2 or older.

Please note that exceptional car loans accumulate passion. Income tax-free treatment likewise thinks the car loan will become pleased from earnings tax-free survivor benefit earnings. Finances and withdrawals minimize the plan's money worth and survivor benefit, may cause specific policy benefits or motorcyclists to become not available and may increase the opportunity the policy may lapse.

4 This is supplied with a Lasting Treatment Servicessm cyclist, which is offered for an added fee. In addition, there are constraints and restrictions. A customer might qualify for the life insurance policy, but not the rider. It is paid as an acceleration of the fatality benefit. A variable universal life insurance contract is an agreement with the main purpose of supplying a survivor benefit.

Is there a budget-friendly Life Insurance Plans option?

These portfolios are carefully managed in order to satisfy stated financial investment goals. There are fees and charges associated with variable life insurance policy contracts, including death and danger fees, a front-end load, management fees, financial investment monitoring charges, abandonment fees and costs for optional cyclists. Equitable Financial and its associates do not provide lawful or tax obligation advice.

Whether you're beginning a family members or getting wedded, individuals normally start to think of life insurance policy when someone else starts to depend upon their capacity to make an earnings. And that's wonderful, since that's exactly what the survivor benefit is for. As you find out more regarding life insurance coverage, you're most likely to find that numerous policies for circumstances, entire life insurance have more than just a fatality advantage.

What are the advantages of entire life insurance coverage? One of the most attractive benefits of purchasing an entire life insurance plan is this: As long as you pay your premiums, your death benefit will never ever end.

Think you don't require life insurance policy if you don't have children? There are many benefits to having life insurance coverage, even if you're not supporting a family members.

How do I cancel Guaranteed Benefits?

Funeral expenditures, burial costs and clinical costs can include up. Permanent life insurance is available in numerous quantities, so you can choose a death advantage that satisfies your requirements.

Figure out whether term or irreversible life insurance policy is best for you. As your individual situations modification (i.e., marital relationship, birth of a youngster or work promo), so will certainly your life insurance needs.

Generally, there are two sorts of life insurance policy prepares - either term or permanent strategies or some combination of both. Life insurance firms use different forms of term plans and standard life policies as well as "interest delicate" items which have actually become more widespread because the 1980's.

Term insurance coverage provides protection for a given amount of time. This period might be as short as one year or provide coverage for a details number of years such as 5, 10, 20 years or to a defined age such as 80 or sometimes up to the earliest age in the life insurance policy mortality tables.

What does Protection Plans cover?

Currently term insurance coverage prices are really affordable and among the most affordable traditionally experienced. It must be noted that it is a widely held idea that term insurance is the least expensive pure life insurance policy protection offered. One requires to evaluate the plan terms carefully to make a decision which term life alternatives are suitable to meet your certain scenarios.

With each brand-new term the premium is enhanced. The right to restore the policy without evidence of insurability is an essential advantage to you. Otherwise, the danger you take is that your health might deteriorate and you might be not able to get a policy at the same prices and even in any way, leaving you and your recipients without insurance coverage.

The length of the conversion duration will certainly differ depending on the type of term policy acquired. The premium rate you pay on conversion is normally based on your "existing achieved age", which is your age on the conversion day.

Under a level term plan the face amount of the policy stays the exact same for the entire duration. With reducing term the face quantity lowers over the period. The costs remains the exact same yearly. Typically such policies are marketed as mortgage security with the amount of insurance coverage reducing as the equilibrium of the home mortgage lowers.

What is the best Cash Value Plans option?

Typically, insurance firms have not can transform costs after the policy is sold. Since such plans might proceed for several years, insurers need to use traditional mortality, interest and expense price estimates in the costs estimation. Flexible premium insurance coverage, nevertheless, allows insurers to use insurance at reduced "current" premiums based upon less traditional assumptions with the right to alter these costs in the future.

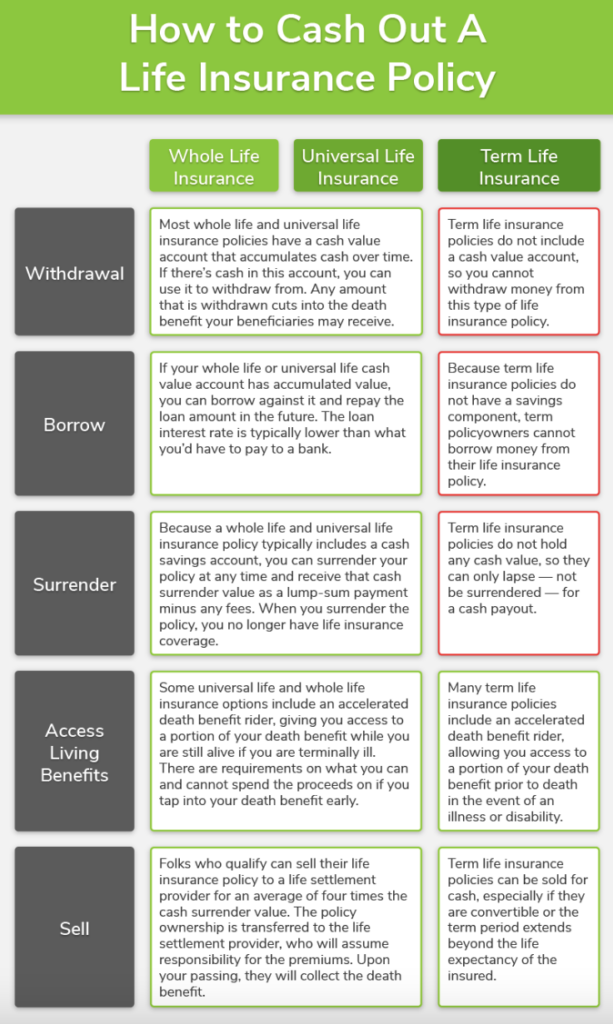

While term insurance coverage is created to supply protection for a defined time duration, irreversible insurance is developed to give protection for your entire lifetime. To maintain the costs rate degree, the premium at the younger ages exceeds the actual cost of defense. This additional costs builds a reserve (cash value) which assists spend for the plan in later years as the cost of security surges over the premium.

The insurance company spends the excess premium dollars This type of policy, which is sometimes called cash value life insurance, creates a cost savings element. Cash money worths are crucial to a permanent life insurance coverage plan.

Table of Contents

Latest Posts

Can I get 20-year Level Term Life Insurance online?

What is Level Benefit Term Life Insurance? Pros, Cons, and Features

Everything You Need to Know About Term Life Insurance With Accelerated Death Benefit

More

Latest Posts

Can I get 20-year Level Term Life Insurance online?

What is Level Benefit Term Life Insurance? Pros, Cons, and Features

Everything You Need to Know About Term Life Insurance With Accelerated Death Benefit