Featured

Table of Contents

That typically makes them an extra inexpensive option for life insurance policy coverage. Numerous individuals get life insurance policy protection to aid financially safeguard their loved ones in case of their unforeseen death.

Or you might have the alternative to transform your existing term coverage right into a permanent policy that lasts the rest of your life. Different life insurance policy policies have possible benefits and disadvantages, so it's important to understand each prior to you decide to purchase a plan.

As long as you pay the costs, your recipients will receive the survivor benefit if you die while covered. That said, it's vital to keep in mind that the majority of plans are contestable for two years which means protection could be retracted on fatality, must a misrepresentation be located in the app. Plans that are not contestable typically have a rated survivor benefit.

What is Term Life Insurance For Spouse? How It Helps You Plan?

Costs are normally reduced than entire life policies. You're not locked into an agreement for the remainder of your life.

And you can not squander your plan throughout its term, so you will not get any kind of economic gain from your past insurance coverage. Similar to various other types of life insurance policy, the expense of a level term plan depends upon your age, insurance coverage needs, work, way of living and health and wellness. Usually, you'll locate a lot more inexpensive protection if you're more youthful, healthier and much less dangerous to insure.

Given that degree term costs stay the exact same for the period of insurance coverage, you'll know exactly how much you'll pay each time. Level term protection additionally has some adaptability, allowing you to personalize your plan with additional functions.

How Does What Does Level Term Life Insurance Mean Help You?

You might have to satisfy particular conditions and certifications for your insurance company to enact this rider. There also can be an age or time limit on the insurance coverage.

The survivor benefit is generally smaller, and protection typically lasts up until your youngster transforms 18 or 25. This motorcyclist might be an extra economical means to aid ensure your children are covered as cyclists can typically cover several dependents simultaneously. Once your child ages out of this coverage, it may be possible to convert the cyclist into a brand-new plan.

When comparing term versus long-term life insurance coverage, it is necessary to keep in mind there are a few different kinds. The most typical kind of irreversible life insurance is entire life insurance policy, but it has some crucial differences compared to degree term insurance coverage. What does level term life insurance mean. Here's a fundamental introduction of what to consider when contrasting term vs.

Whole life insurance policy lasts permanently, while term coverage lasts for a specific period. The costs for term life insurance policy are commonly less than entire life coverage. However, with both, the premiums continue to be the very same throughout of the policy. Entire life insurance policy has a money value element, where a part of the costs might grow tax-deferred for future needs.

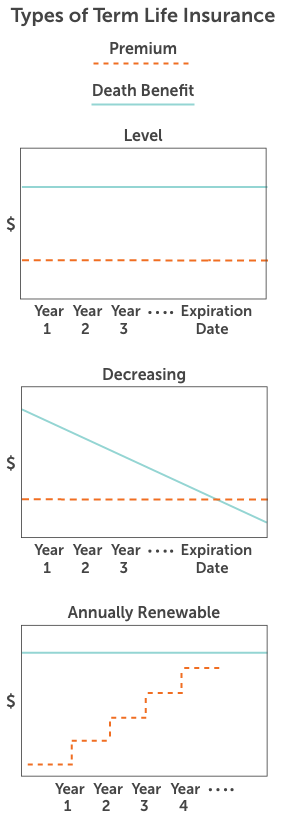

One of the primary attributes of level term coverage is that your premiums and your fatality advantage don't alter. You might have coverage that begins with a death benefit of $10,000, which can cover a mortgage, and then each year, the fatality benefit will reduce by a collection quantity or percent.

As a result of this, it's typically an extra budget friendly kind of degree term protection. You may have life insurance policy via your employer, yet it might not suffice life insurance for your requirements. The initial step when buying a plan is identifying just how much life insurance policy you require. Consider factors such as: Age Family members dimension and ages Employment condition Revenue Financial debt Lifestyle Expected last costs A life insurance policy calculator can aid figure out how much you need to begin.

What is the Coverage of Term Life Insurance For Couples?

After making a decision on a plan, complete the application. For the underwriting procedure, you might have to supply general individual, health and wellness, way of living and employment details. Your insurance firm will establish if you are insurable and the danger you may present to them, which is mirrored in your premium expenses. If you're approved, sign the documentation and pay your first premium.

You may want to upgrade your recipient info if you've had any type of substantial life adjustments, such as a marriage, birth or divorce. Life insurance policy can in some cases feel complex.

No, degree term life insurance policy doesn't have cash money value. Some life insurance policies have a financial investment attribute that permits you to develop cash money value in time. A portion of your premium payments is established apart and can earn passion gradually, which expands tax-deferred throughout the life of your coverage.

You have some options if you still desire some life insurance coverage. You can: If you're 65 and your protection has run out, for example, you might want to get a new 10-year level term life insurance coverage plan.

Everything You Need to Know About Term Life Insurance Level Term

You might be able to transform your term insurance coverage right into an entire life policy that will last for the rest of your life. Lots of kinds of degree term policies are exchangeable. That implies, at the end of your insurance coverage, you can transform some or every one of your plan to entire life protection.

A level costs term life insurance coverage strategy allows you stick to your budget while you help shield your family. ___ Aon Insurance Providers is the brand name for the brokerage and program management procedures of Fondness Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Company, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Providers Inc.; in CA, Aon Fondness Insurance Policy Solutions, Inc .

Latest Posts

How Does Burial Insurance Work

Instant Life Insurance Quote

End Of Life Insurance